child tax credit september 2021

Staff Report September 21 2021 311 PM Child tax credits are sent to families around the 15th of every month unless there is some other issue. With a 600 bonus for kids under the age of 6.

Child tax credit september 2021 deposit date.

. The September installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail. Published Wed Sep 22 2021 1232 PM EDT. Many worried about why September child tax credit didnt show up yet.

But during 2020 had successfully registered for Economic Impact Payments using the IRS Non. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

Because the CTC is a tax credit for the 2021 tax year children born in the current calendar year qualify for the payments. Child tax credit dates 2021 latest August 30 deadline to opt-out of September payments as parents flock to IRS portal. Here is some important information to understand about this years Child Tax Credit.

The IRS issued a formal statement on September 24 which anyone missing their September payment should read. September 17 2021. That drops to 3000 for each child ages six through 17.

The advance is 50 of your child tax credit with the rest claimed on next years return. Some parents still havent received the September child tax credit payment. 1002 ET Aug 27 2021.

September 2022 Child Tax Credit Missing September 2022 Child Tax Credit Missing. Since democrats boosted the maximum value of the child tax credit to 3600 in 2021. Thats up to 7200 for twins This is on top of payments for any other qualified child.

But families with children born in 2021 need to take an. The Child Tax Credit provides money to support American families. Parents report problems receiving September child tax credit Published Fri Sep 17 2021 318 PM EDT Updated Fri Sep 17 2021 729 PM EDT Alicia.

The credit is 3600 annually for. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. It will also let parents take advantage of any increased.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The IRS issued about 15 billion in child tax credit payments to about 35 million families this month. We need this money.

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The third payments of 2021 are scheduled to go out to the parents of roughly 60 million children in September courtesy of the Internal Revenue Service IRS.

This months is late. IRSnews IRSnews September 18 2021. During the week of September 13-17 the IRS successfully delivered a third monthly round of approximately 35 million advance Child Tax Credits CTC totaling 15 billion.

This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. That depends on your household income and family size.

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Issues Employer Guidance On Covid 19 Paid Leave Tax Credits Cupa Hr

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Publications Columbia University Center On Poverty And Social Policy

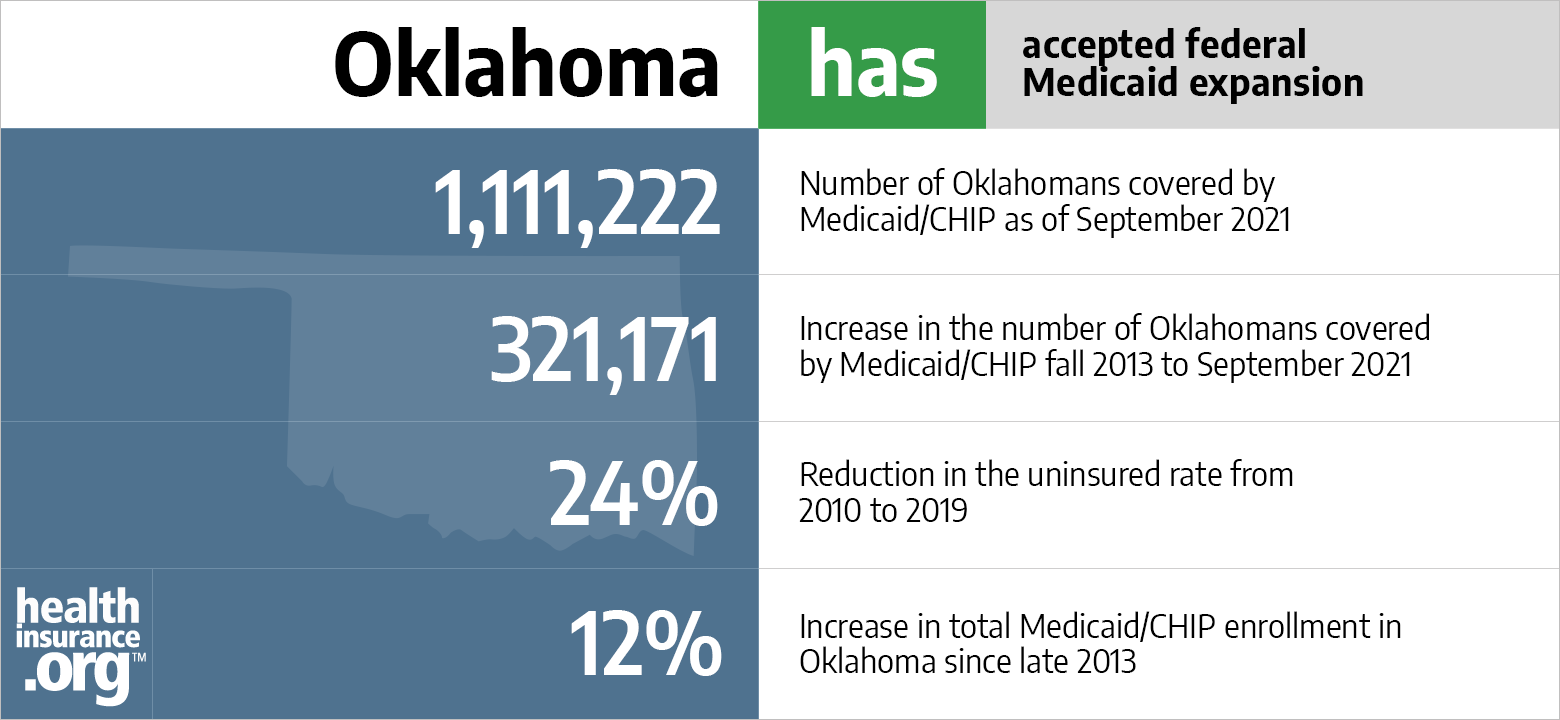

Aca Medicaid Expansion In Oklahoma Updated 2022 Guide Healthinsurance Org

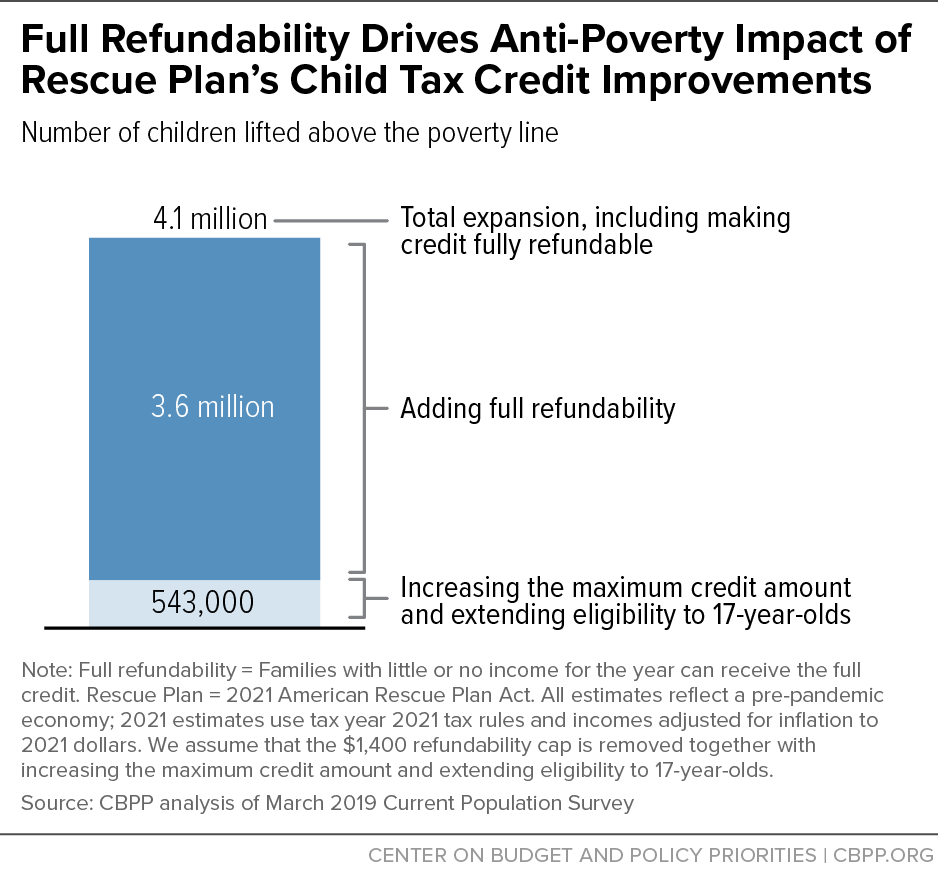

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Child Tax Credit Children 18 And Older Not Eligible 13newsnow Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities